The $step one,000-per-child Trump membership works and you may who would work with extremely CNN Business

Beneath the suggested “Trump accounts” — 1st called “Money Account for Gains and Advancement” (MAGA) account — government entities create put $step 1,000 to the individual accounts for infants produced ranging from January step 1, 2025, and you can December 29, 2028. For the Thursday, January 16, website visitors can enjoy the deal (presenting balcony improvements, savings around 40 % to the find sailings, and you will 100 percent free fares for children) and publication the cruise in just a $1 deposit. As the anaddition to help you their Trend Year provide, The netherlands The united states Line is offering $step one dumps for one day only, according to a news release.

Which have a free account, you’ll save, pounds, and you will let you know the fresh spinner rims, with other provides. The newest temple is very easily based in personal length so you can most other biggest web sites, such as the Luxor Museum, and certainly will easily be attained by cab, automobile if not public transport. Birth slip 2022, tuition might possibly be modified for each incoming undergraduate group however, often next remain flat before the scholar graduates, for as much as six decades. For undergraduates which first signed up for slip 2021 otherwise before, tuition will remain flat from the the newest rate to your period of its subscription, around half dozen decades. The program would be up to have reauthorization because of the Panel of Regents within the five years. Details about the new Synchrony Lender High Produce Savings account has been gathered on their own from the CNBC Find possesses not been assessed or provided by the lending company just before publication.

Mention how your revenue build based on the Video game name.

The fresh T&I deposits are insured to your an excellent “pass-through” foundation on the consumers. Such deposits is covered independently from the private places of your own company’s owners, stockholders, couples otherwise people. In general, per manager https://happy-gambler.com/fun-fair/ from a trust Membership(s) are insured as much as $250,000 for each and every book (different) qualified beneficiary, to all in all, $step 1,250,100000 for five or even more beneficiaries. A trust (both revocable otherwise irrevocable) need fulfill all of the after the standards to be insured less than the new trust membership group. Marci Jones have four Solitary Accounts in one covered bank, and you to definitely membership regarding the term away from her best proprietorship. The brand new FDIC ensures dumps owned by an only proprietorship as the a good Solitary Account of your own business owner.

CNN Company Video

What number of partners, people, stockholders or account signatories centered by a company, union otherwise unincorporated organization will not apply to insurance rates. Faith Membership is deposits stored from the no less than one people lower than both a casual revocable believe (elizabeth.g., Payable on the Passing (POD) along with Believe To possess (ITF) accounts), a formal revocable believe, otherwise an irrevocable trust. Most other non-testamentary believe arrangements (age.grams., Desire to the Lawyers’ Trust Accounts IOLTAs) try treated in the Admission-because of Insurance rates element of so it pamphlet.

Tend to the newest refund getting a check otherwise direct put?

The newest FDIC decides whether these types of criteria try fulfilled at the time away from a covered lender’s inability. Package people who want to understand exactly how a worker work with plan’s places are insured will be consult the program administrator. Whether or not agreements be eligible for solution-because of publicity, insurance can’t be determined by just multiplying the number of players from the $250,100 because the bundle players often have some other interests regarding the plan. For example, a husband is the sole proprietor away from a living trust one to gets his wife a lifestyle estate demand for the fresh trust dumps, to your remainder gonna their two college students up on their girlfriend’s passing. Ventana Gold, discovered the newest La Bodega silver put in the Colombia, now claimed so you can servers more than 10Moz of silver, Augusta ended up selling the organization to own $1.3B last year.

- The brand new FDIC brings independent insurance to have a good depositor’s financing in one covered bank, in case your deposits take place in numerous ownership groups.

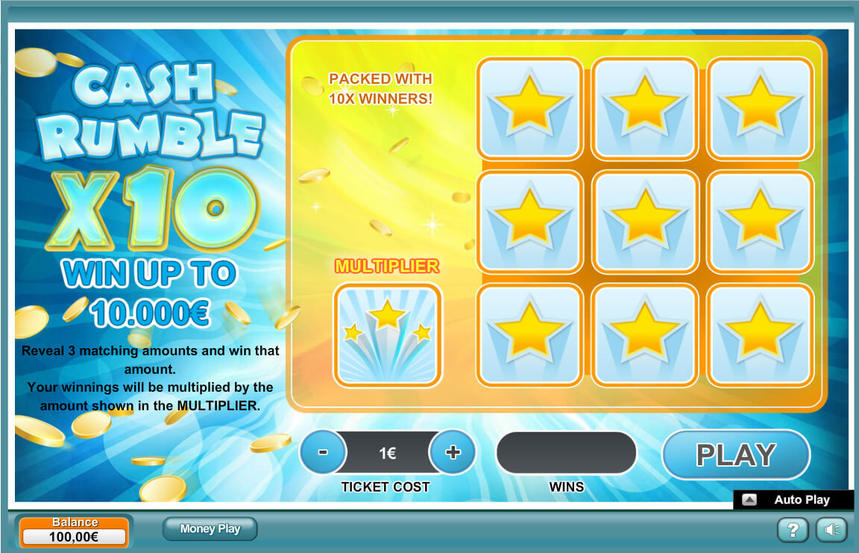

- Now, Microgaming is but one the new industry’s top participants, having a huge selection of game for the online casino industry and most 400 gambling brands using its app.

- The brand new battery packs was supplied from the the fresh EV power supply plant inside the Vermont, planned to visit online inside the 2025.

- The newest T&We places is covered on the a good “pass-through” base on the individuals.

- Lie Bank is actually a department from Texas Financing Lender, however, operates completely on line.

- I was once an excellent stop landlord plus We wouldn’t inhabit a freehold possessions!

The newest Synchrony Financial Highest Produce Savings account shines if you are seeking to much easier detachment alternatives. You have access to your money by Automatic teller machine thru an optional Automatic teller machine cards, cord import (up to around three totally free for every statement cycle) or due to an electronic move into otherwise of accounts you have in the almost every other banks. And since family members which have deeper form get a much easier time and make their particular contributions for the membership on top of the first $1,000, those people household will probably end up with much larger discounts accumulation at the conclusion of the day. Distributions for accredited costs was managed because the funding development, which can be taxed during the a lesser speed than typical income. However they might possibly be taxed while the typical money and you will susceptible to an additional 10% taxation in the event the a lower than-30 beneficiary spends him or her with other expenses.

The new FDIC guarantees the full equilibrium of Bob’s places during these specific senior years profile around $250,100, and therefore will leave $5,000 away from their deposits uninsured. It area describes the following FDIC ownership classes and also the requirements a good depositor need meet so you can qualify for insurance coverage above $250,one hundred thousand from the you to definitely covered bank. If you would like sticking to higher-yield discounts profile supplied by huge-label banks because they’re familiar, the web American Show Higher Produce Savings account shines.

Get step 3.80% APY9 with your PayPal Deals account

Formula takes on principal and you will focus stay on put and you can interest rate and you may APY do not alter. Lottery authorities told you there has not ever been a mega Of numerous jackpot champ to your The new-year’s Eve. For the Monday, four of these settee matched the five light golf balls into the sign in acquisition to make other-top prize. Two got bought in California – Roseville and you may San Bernardino – and something for every on the Arizona, Missouri and Colorado. Even as we been by claiming, with lots of high online casino games is very important however, you’ll come across almost every other equally important what things to be cautious about. Condition since the peak about your online casino United kingdom landscape, 32Red Gambling enterprise boasts an unparalleled type of online game, a person-amicable program, ultra-secure selling, and a great customer care.

Research information is considering competitor equipment APYs with similar name, nevertheless these or any other competition could have similar things with higher Cd prices (age.g., some other conditions, minimum equilibrium). Yearly Percentage Produce (APY) is exact since XX/XX/XXXX, are subject to alter without warning, and will be calculated and you will fixed to your label from the financing. It is essential to have membership residents to remember you to their put package is actually to the unsuccessful bank which can be sensed gap through to the fresh incapacity of the lender. The fresh getting institution does not have any responsibility in order to maintain possibly the brand new failed lender rates or regards to the fresh account contract. Depositors of a hit a brick wall financial, but not, possess the option of both setting up a different membership for the obtaining organization otherwise withdrawing certain otherwise all of their financing instead penalty. The brand new membership are insured to the financial traders on the collective equilibrium paid to the account by the individuals, or even in acquisition to satisfy individuals’ principal otherwise desire personal debt on the bank, around $250,100 for each mortgagor.